Pinging @Barbara and @dognose – I’m not sure who has lead on this feature – but today was another good example of DESS not behaving in an optimal way with negative prices. As before, VRM installation ID 510670, 25/06/2025 AEDT for your reference.

Between 1130-1200 and 1230-1430, buy and sell prices were negative in my part of the world, and DESS knows about those prices (see here) but didn’t make best use of that opportunity.

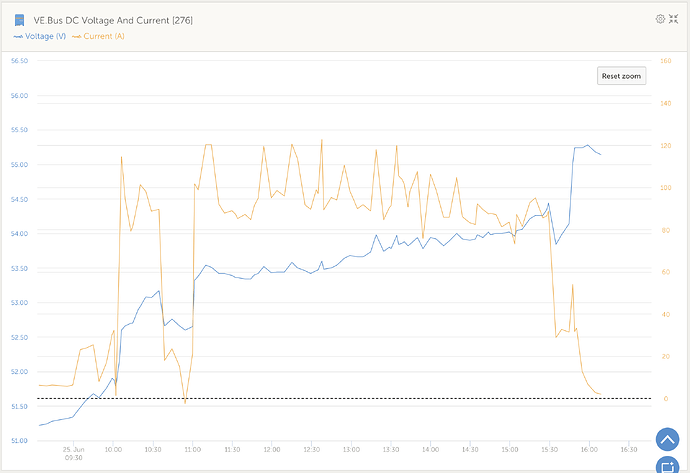

Running in trade mode, I would expect DESS to run all loads from the grid and maximise charging to the batteries, as we are being paid to use electricity. Instead, DESS continued to first use all the available solar, then top up the batteries at a lower rate of charge (presumably to reach the target SoC for that period of the schedule) from the grid. My environment has two Multiplus II 48/5000s in parallel, giving me a theoretical maximum DC charge rate of ~140A – what we saw was a charge rate of mostly around the ~80-90A and little “peaks” to ~120A throughout the day:

I have worked on the assumption that the system’s charge theoretical max charge capacity is reduced by any AC loads the inverter is supplying (in this case, there is ~1000W of AC-OUT load, even though we’re on-grid at this point).

If DESS was in green mode, I could accept this behaviour: in the pursuit of “green-ness”, prioritising a low-carbon energy source over a potentially higher-carbon energy source might be acceptable (though, paradoxically, when the price is low or negative in my part of the world, it is due to an oversupply of renewables!). But the behaviour of not maximising profitability (or even maximising charge rate) when prices are negative doesn’t make any sense.

Would love to hear from Victron staff if this is expected behaviour and indeed help with any testing moving forward.